capital gains tax usa

A flat tax of 30 percent is imposed on US. Taxpayers with modified adjusted gross income.

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Long-term gains are taxed at lower rates up to 20 percent.

. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or. As part of this there is a long-term capital gains tax which is a 20 tax on investments held for more than. The highest-earning people in the United States pay a 238 tax on capital gains.

Short-term capital gains are gains apply to assets or property you held for one year or less. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. The estate tax exclusion will grow in 2023 to 1292 million from 1206 million in 2022.

The capital gains tax on most net gains is no more than 15 for most people. That means that until your estate exceeds 1292 million you will not owe any tax. Short-Term Capital Gains vs Long Term.

Capital gains taxes on assets held for one year or less correspond to ordinary income tax brackets. They are subject to ordinary income tax rates meaning theyre. Source capital gains in the hands of nonresident alien individuals physically present in the United States for 183 days or more during the taxable year.

While the US does have a federal. This usually happens from the sale of an. If you sell stocks mutual funds or other capital assets that you held for at.

2022 federal capital gains tax rates. Weve got all the 2021 and 2022 capital gains. Most long-term capital gains are taxed at rates of 15 or less.

Learn more about who pays capital gains taxes on a deceased estate. Short-term capital gain tax rates. Learn more about who pays capital gains taxes on a deceased estate.

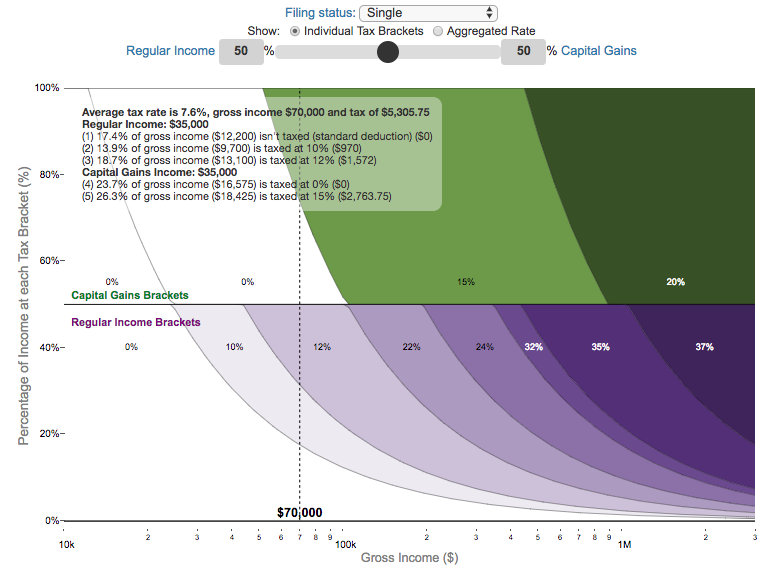

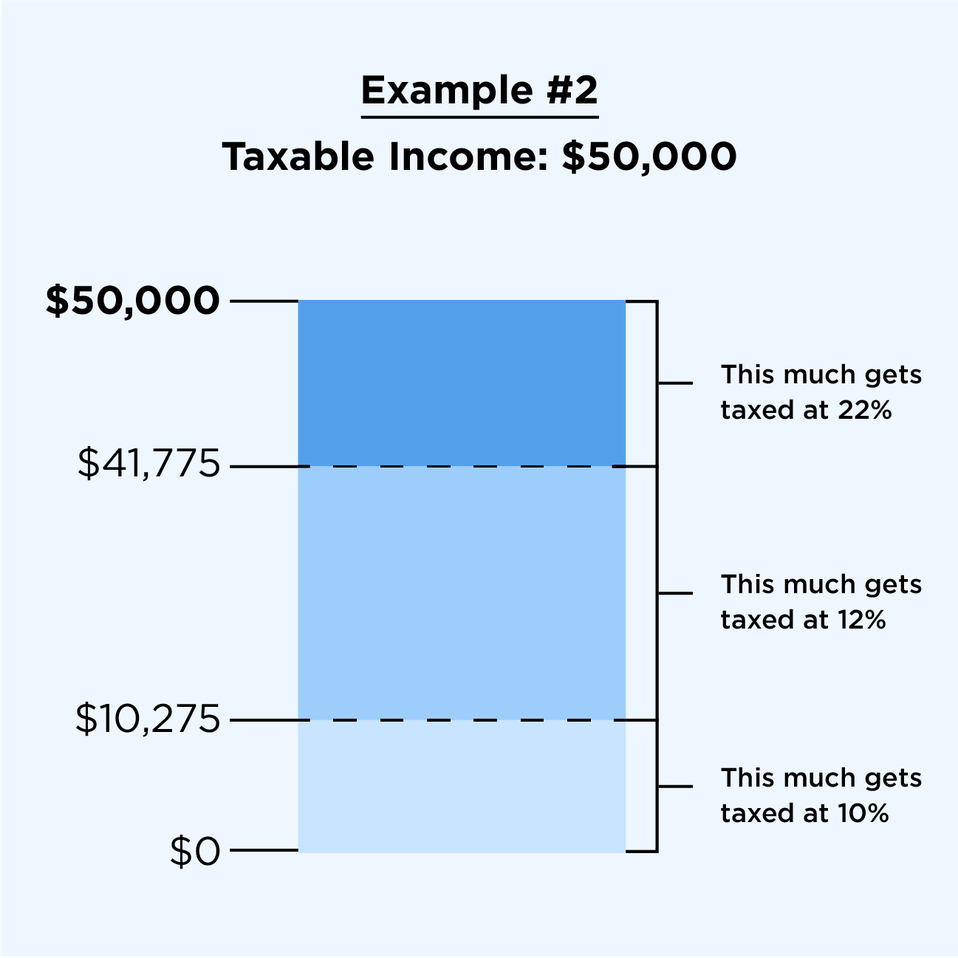

At the state level income taxes on capital gains vary from 0 percent to. Just like income tax youll pay a tiered tax rate on your capital gains. Which capital gains tax rate applies to 2023 long-term gains will depend on your taxable income.

If your taxable income is less than 80000 some or all of your net gain may even be taxed at 0. In addition to federal taxes on capital gains most states levy income taxes that apply to capital gains. You must report all 1099-B transactions on Schedule D Form 1040 Capital Gains and Losses and you may need to use Form 8949 Sales and Other Dispositions of Capital.

The amount taxed for capital gains depends on the income of the taxpayer and their filing status. Short-term capital gains are taxed as ordinary income at rates up to 37 percent. In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes.

The capital gains tax rate is 0 15 or 20 on most assets held for more than one year. If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately. Capital gains tax USA property occurs when an asset is sold for more than what was paid to acquire it.

For example a single person with a total short-term capital gain of.

Managing Tax Rate Uncertainty Russell Investments

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

Ending Special Tax Treatment For The Very Wealthy Center For American Progress

Should The United States Abolish The Capital Gains Tax Kialo

Ultimate Crypto Tax Guide 2022 Koinly

Crypto Tax 101 What Is Cryptocurrency Capital Gains Tax Koinly

Visual Guide To Understanding Marginal Tax Rates Engaging Data

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Rsu Taxes Explained 4 Tax Strategies For 2022

Real Estate Capital Gains Tax Rates In 2021 2022

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Capital Gains Taxes Are Going Up

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

The Ultimate Crypto Tax Guide 2022 Coinledger

How Are Capital Gains Taxed Tax Policy Center

Can Capital Gains Push Me Into A Higher Tax Bracket

2022 2023 Federal Income Tax Brackets Tax Rates Nerdwallet

Short Term Vs Long Term Capital Gains White Coat Investor

Biden To Propose Capital Gains Tax Of 39 6 On Investors Earning 1m Or More Marketplace